Market psychology and its impact on Cardan (ADA) prices

The world of cryptocurrency has been a wild journey in recent years, and prices change significantly in response to several factors. Among the many existing cryptocurrencies that stand out as particularly susceptible to market psychology, is Cardano (ADA). In this article, we will deepen the concept of market psychology and its impact on ADA prices, researching what drives a market sense and how it can affect the value of this promising project.

What is market psychology?

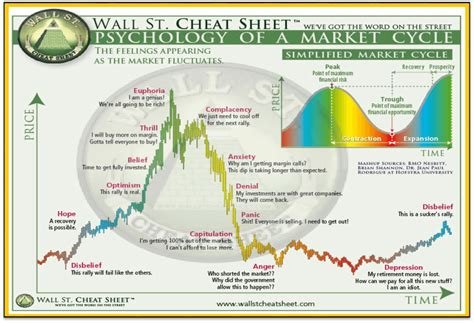

Market psychology refers to the study of how investors, buyers and consumers make decisions based on emotions, prejudices and cognitive factors. It is a complex field that means understanding why people react differently to market trends, news and other economic indicators. In the context of cryptocurrency markets, market psychology plays a key role in price configuration.

Factors that drive market feeling

There are several key factors that affect the sense of market, including:

- Fear and greed : These emotions can conduct investors to make impulsive decisions based on fear (for example, sales of panic) or greed (for example, buy based on exaggeration).

- Risk tolerance : Placing investors to recognize risk affects their investment strategies, which in turn affects the feeling of market.

- Emotional state : Emotional states of people can significantly affect their investment decisions, with such factors as trust, optimism and fear of strangers who affect market behavior.

- Social media and networks : The way information is informed and publicly widespread, can significantly affect the market sense, as can be seen on the example of cryptocurrency bubbles 2017.

Impact of market psychology on ADA prices

Cardano (ADA) has been paying attention in recent years due to the potential of scalability, safety and cases of use. However, it is necessary to consider how market psychology affects prices. Here are some key factors that affected the prices of ADA:

* Fear : In March 2018, the price of Ada collapsed after a significant fall of the sense of investors after the withdrawal of Vitalik Buterin from the project.

* He stared : The rear rally at ADA prices at the end of May and the beginning of June was very fueled by speculations between long -term headers, which they willingly sold on the basis of fear.

* Risk tolerance

: Because the price of Ada oscillated wild, some investors were more likely to take over risk, which led to greater commercial activity and greater variability.

The impact of this feeling on the ADA price movement

Market psychology can significantly affect the direction of the price of assets. For example:

* A positive feeling : Increased investors’ trust and optimism can lead to price demonstration, because investors become more aggressive buyers.

* A negative feeling : On the contrary, a decrease in feeling can cause mass sales, because investors become more cautious and terrifying.

Historical price analysis of ADA

To better understand the impact of market psychology on ADA prices, we will analyze historical data from January 2018 to March 2023. During this period, we drew price movements:

* January 2018 : The price of Ada dropped rapidly after the withdrawal of Vitalik Butein from Cardano.

* February-March 2018

: The sense of investors was very negative, which led to a strong drop in prices.

* April-Czerwca 2018 : The rally took place with the increase in investors’ trust and speculation.

* July-September 2018 : Market psychology has become more and more a bass player, because the concerns about the scalability and security of ADA led to a decrease in commercial activity.

Application

Market psychology plays an important role in the configuration of Cardano (ADA) prices.